더킹플러스카지노 공식 홈페이지 | 로즈카지노 후속 신규가입 | 100% 보너스 및 쿠폰

더킹플러스카지노

더킹플러스카지노는 현대적이고 편안한 분위기의 온라인 카지노 플랫폼으로, 다양한 카지노 게임과 높은 품질의 서비스를 제공하는 카지노사이트로 즐기는 사용자들에게 편리함과 안전성을 중요시하며, 최신 기술과 공정한 게임으로 사용자들에 최상의 카지노 경험을 선사합니다.

공식사이트에 오신걸 환영합니다.

더킹플러스카지노에 대해

우리카지노가 출범한 2008년 후 우리계열 카지노사이트 중 항상 독보적인 1등 카지노게임사로 자리잡은 33카지노,더킹카지노,메리트카지노에서 로즈카지노까지 오랜 역사와 전통을 자랑하는 카지노사이트 입니다.다시한번 명성을 드높일 준비를 마쳤으며 고객분들의 요구에 발맞춰 에볼루션 라이센스 추가로 새롭게 업그레이드 된 여기 더킹플러스카지노에서 새로운 재미를 느껴보세요.

.추가로 공식 홈페이지 인 저희 더킹플러스카지노 외에 다른 유사 홍보사이트에서 불이익을 보지 않게 주의하세요.

제공하는 대표 인기게임 추천

바카라,라이브바카라

가장 사랑받는 게임은 단연 바카라 일 것입니다.최고의 라이브딜러 시스템을 적용해서 실제 카지노에 와 있는 듯한 현장감 있는 게임을 즐겨보세요.

룰렛,유럽룰렛

두 가지 유형의 룰렛을 제공합니다.일반적인 미국식과 유럽식으로 나뉘는데 미국식은 00이 추가되어 확률이 조금 떨어지는 단점이 있습니다.오늘의 숫자에 베팅해 보세요!!

블랙잭

복잡한 경우의 수를 딜러와 치밀하게 싸우는 스타일을 좋아하시는 분들이 정말 좋아하는 게임입니다.카지노 게임 중 가장 승리할 확률이 높은 블랙잭을 도전해 보세요.행운을 빕니다.

슬롯

잭팟의 행운이 기다려지는 슬롯게임 입니다.여러가지 슬롯게임을 제공하며 인내와 끈기를 가지고 도전해 보세요.대박의 행운을 기원합니다.

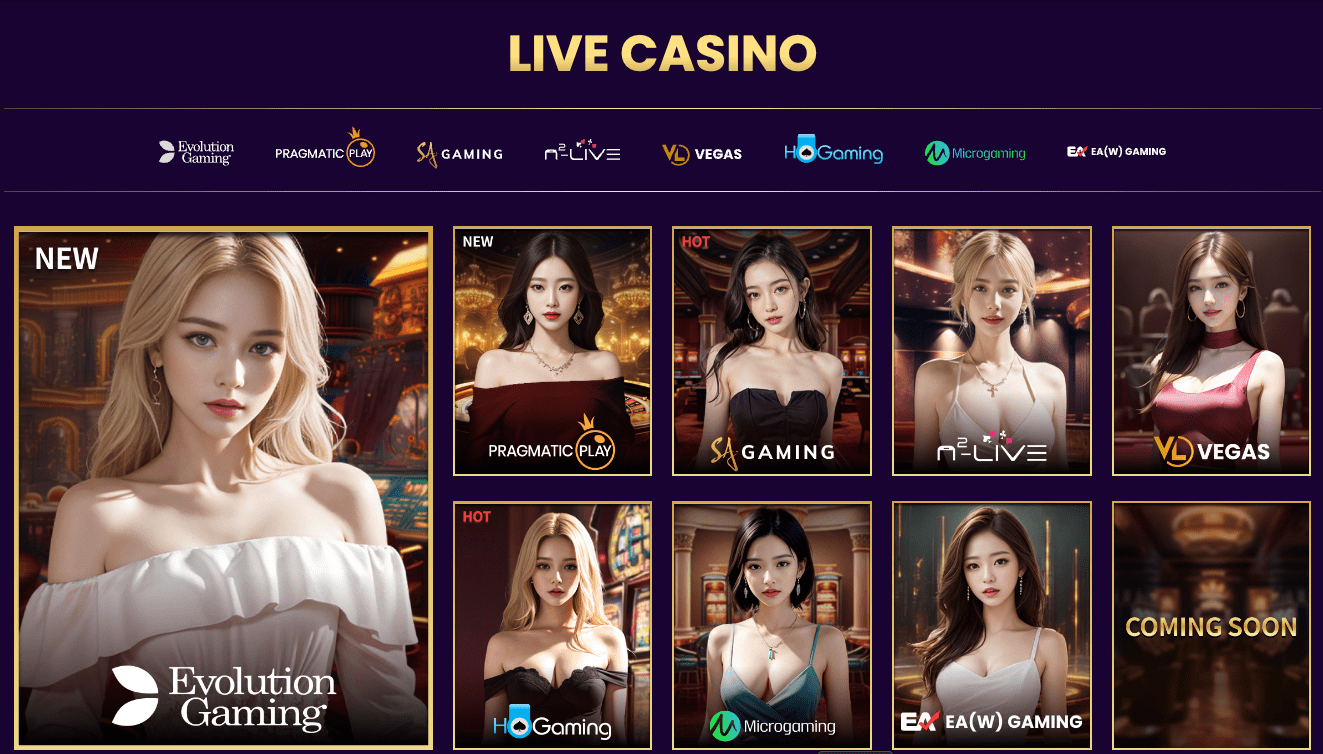

LIVE CASINO

에볼루션, 프라그마틱 입점! • 사칭 사이트에 주의하세요! • 게임실행 오류시 팝업차단 해제,쿠키삭제 후 실행하시기 바랍니다.

라이브 카지노

새롭게 선보이는 에볼루션,프라그마틱 게임을 만나보세요.기존 인기게임 인 SA,HO 게임은 물론 준비되어 있습니다.더욱 더 선명해진 게임 화질과 매끄러운 운영,몰입감 있는 게임 진행까지 기존과 차별화 된 카지노게임을 경험해 보세요.

SLOT GAME

슬롯게임

프라그마틱의 슬롯게임을 경험해보세요.새로운 재미로 고객분들의 흥미를 자극할겁니다.또한 인기있는 마이크로 게이밍과 언제나 행운을 기대하게 만드는 퀸메이커까지 오늘의 행운을 시험해 보세요!

신규 런칭 이벤트 & 보너스

신규 런칭 이벤트 가입쿠폰 3만

새롭게 신규가입 하시는 고객분들에게 제공되는 신규가입 3만 쿠폰 보너스 입니다.가입 후 꼭 혜택 받으세요.

첫 입금7%,재 입금 7%

입금 보너스

입금액의 따라 게임머니를 추가로 제공해드리는 서비스입니다.평일과 주말은 제공되는 혜택의 차이가 있습니다.단 추가 보너스 한도가 있으니 이점 잘 확인부탁드립니다.

일간 루징 5%,주말 루징 5%

게임머니를 모두 잃었다고 실망하지마세요.루징 금액의 일정부분을 쿠폰으로 돌려드립니다.다시 한번 도전해 보세요.

각종 이벤트 상시 오픈

공식사이트의 공지사항을 수시로 잘 확인하세요.각종 이벤트를 상시 오픈하니 잘 확인하시고 게임의 재미를 더하세요.

더킹플러스카지노는 우리카지노계열 No.1 카지노사이트 입니다.

더킹플러스카지노가 최고인 이유